What Home Improvements Can You Claim On Your Taxes

Renovation of a home is not generally an expense that can be deducted from your federal taxes, but there are a number of ways that you can use home renovations and improvements to minimize your taxes. these include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Money you spend on your home breaks down into two categories, tax-wise: the cost of improvements versus the cost of repairs. capital improvements. you add the cost of capital improvements to your tax basis in the house. your tax basis is the amount you'll subtract from the sales price to determine the amount of your profit.

If you need to make changes to your home to improve access or to alleviate exacerbating medical issues, you can absolutely deduct the costs on your tax return. these "improvements" are considered medical expenses and are not to be mistaken for projects that increase the value of your home. As a homeowner you might be asking yourself if there are any tax deductible home improvements i can claim? the answer could be yes. you can include the expense of capital improvements to the tax basis of your property. your tax basis is the sum of money you will subtract from the sales price to establish your profit.

Federal Tax Deductions For Home Renovation Turbotax Tax

For tax purposes, a home improvement includes any work done that substantially adds to the value of your home, increases its useful life, or adapts it to new uses. these include room additions, new bathrooms, decks, fencing, landscaping, wiring upgrades, walkways, driveway, kitchen upgrades, plumbing upgrades, and new roofs. Homeimprovements may come into play when you sell your home because they're included in your home's adjusted cost basis. the bigger your basis, the smaller your capital gain, and that means less tax if your home sale profit exceeds $250,000 ($500,000 if you're filing jointly). read more about the tax implications of home sales. However, there are some ways that home repairs can lower your tax bill. there are tax deductions and credits available that are applicable when you first purchase the home and even afterward. learn how you can claim home repair tax deductions. that much of comfort when you are at home here are some improvement ideas that can turn your house to be a relaxing shelter which you can always count on installing a jacuzzi tub nothing is more relaxing your day much less stressful and enjoyable you can use a ball chair in the office or even at home when on the computer your spine is what keeps you upright, and it is the main carrier of

3 plan to make improvements after your home is assessed for property taxes. if you’re anything like what home improvements can you claim on your taxes most people, you don’t have the money to waste paying extra taxes. scheduling your home renovations appropriately can save you money on your property taxes—for this year, at least. contact your local assessor’s office to find out when valuations occur so you can plan your project for afterwards. When you make a home improvement, such as installing central air conditioning or replacing the roof, you can't deduct the cost in the year you spend the money. but, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house.

3 plan to make improvements after your home is assessed for property taxes. if you’re anything like most people, you don’t have the money to waste paying extra taxes. scheduling your home renovations appropriately can save you money on your property taxes—for this year, at least. “if you needed to make home improvements in order to sell your home, you can deduct those expenses what home improvements can you claim on your taxes as selling costs as long as they were made within 90 days of the closing,” says zimmelman. 3.

Yes, if your windows qualify as an energy efficient improvement. these are entered in the deductions & credits section:. with your return open, search for energy improvements in the program search box. (don't search for "energy credit," as this will take you to the wrong place in the program. ). The improvements to a home office space are completely deductible, so long as you're meeting all the home office guidelines. just remember that you'll probably have to depreciate them as well, unless they're repairs. and here's an extra bonus. say you add an air conditioner or new water tank to the home. Improvements to your home what home improvements can you claim on your taxes can also be deducted from your income as medical expenses if they are medically necessary. the cost of installing entrance or exit ramps, modifying bathrooms, lowering cabinets, widening doors and hallways and adding handrails, among others, are home improvements that can be deducted as medical expenses. On your personal residence, the answer is usually no, although you might qualify for certain kinds of energy-related home improvements. home improvements may come into play when you sell your home because they're included in your home's adjusted cost basis. the bigger your basis, the smaller your capital gain, and that means less tax if your home sale profit exceeds $250,000 ($500,000 if you're filing jointly).

Remember that you can't just claim any old space as your home office; you have to meet some strict requirements from the irs (i. e. it can't be a space the rest of the family uses recreationally). the improvements to a home office space are completely deductible, so long as you're meeting all the home office guidelines. It’s no secret that finishing your basement will increase your home’s value. what you may not know is that you may be eligible for tax breaks for capital improvements on your home when you sell. tax rules let you add capital improvement expenses to the cost basis of your home. Certain energy-generating modifications can also allow you to lower your taxes. energy tax credits can be worth up to 30% of the cost of installation.. these credits apply to improvements like solar panels, wind turbines, fuel cells, geothermal heat pumps, and solar-powered water heaters.

What Home Improvements Are Tax Deductible Nolo

Can I Deduct Home Improvements On My Tax Return

Youcan deduct improvements made on your property, however you cannot deduct the full value of the improvement in the year the improvement occurred. this is because an improvement adds value to your property for years to come, not just in the current year. They can help reduce the amount of taxes you have to pay when you sell your home at a profit. this is because the cost what home improvements can you claim on your taxes of home improvements are added to the tax basis of your home. "basis" means the amount of your investment in your home for tax purposes. the greater your basis, the less profit you'll receive when you sell your home. Partial improvements are also eligible, so you don’t need to replace every window in your home to qualify for this tax credit. it also applies if you added a window that wasn’t there previously. you may claim 10% of the total cost up to a maximum of $200, for new windows.

How do i get a tax credit for home improvements? home.

Deducting home improvements from home sale profit. if you make substantial physical improvements to your home -even if you did them years before you started actively preparing your home for sale -you can add the cost to its tax basis. this will reduce the amount of any taxable profit from the sale. Thanks to the american recovery and reinstatement act, you can get tax credits on 30 percent of the cost of all qualifying energy-efficient improvements to your home. you can also claim a tax. There are home improvements you can also make that technically count as medical expenses. the catch is they must be considered a medical necessity. for example, you can install entrance ramps, create modified bathrooms, lower cabinets, widen doors, add handrails, and create special doors. Keeping records of home-related expenses. all records should be kept for 2019 and future tax returns. for instance, any home improvement costs can add up over the years, so it is a good idea to keep records for each year in case you receive an irs notice requesting more information about your tax returns.

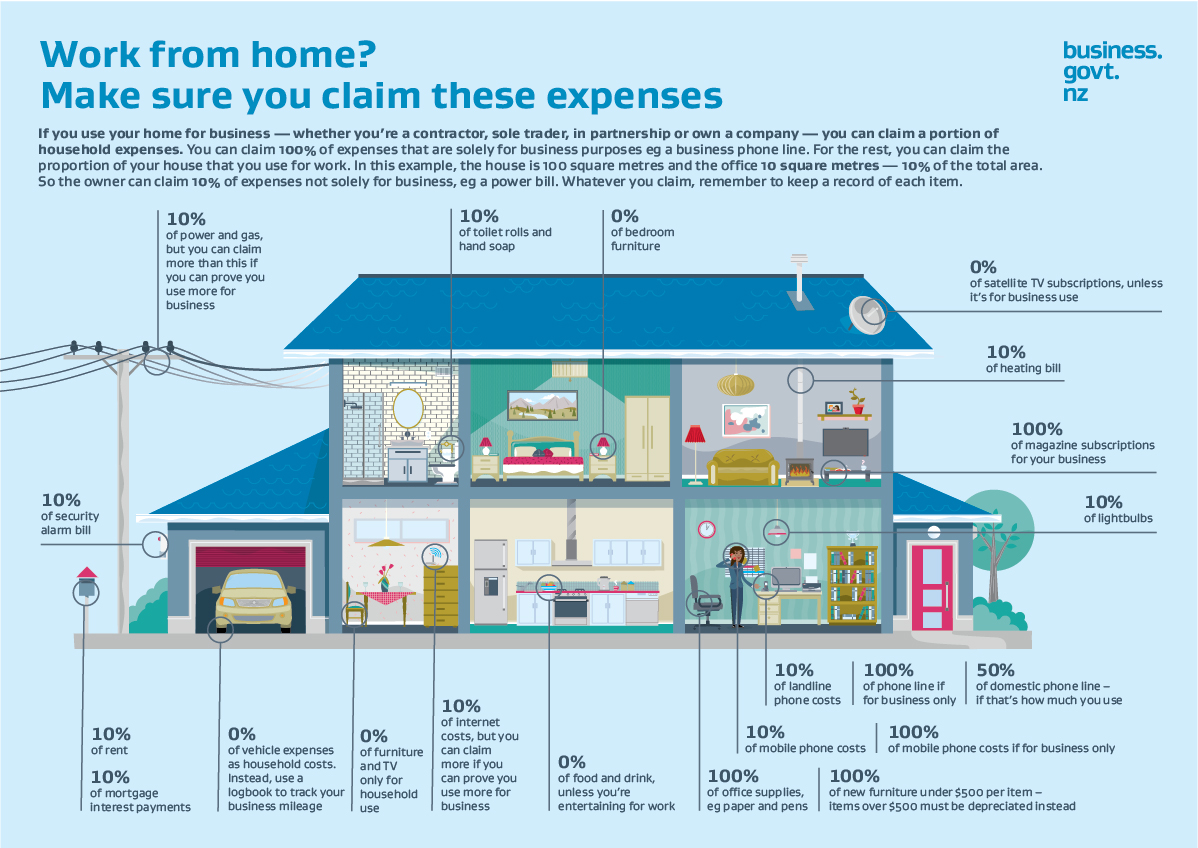

Once you make a home improvement, like putting in central air conditioning, installing a sun-room, or upgrading the roof, you are not able to deduct the expense during the year you spent the funds. you should maintain a record of those costs; they might help you to claim a home improvement tax deduction when you sell your home. The biggest tax breaks are enjoyed by owners who work from home and can claim a home office deduction as well as deductions for improvements to their offices or homes and rental property. If 200 square feet of your 2,000-square-foot home is a home office, you can write off $60, or 10 percent, of the cost of the repair with your home-office deduction.

Komentar

Posting Komentar